Issue #1 – Sunday, November 23, 2025

What’s in This Report

Michigan’s Data Center Reality: Two projects show opposite outcomes. Saline approved with $14M in community concessions after lawsuit settlement, pending MPSC, Howell rejected after 7-hour public hearing with overwhelming opposition. The difference wasn’t the proposals. It was how communities organized.

The Power Grid Math: DTE Energy serves 9.5GW at peak with 11GW total capacity. Data center pipeline in discussions: 7GW. That would consume their entire remaining capacity—which explains why your residential electricity rates are climbing while these facilities negotiate special discounts.

What We’re Tracking: 10 verified national infrastructure projects worth $81B combined, 10 enterprise AI deployments affecting millions of workers, and the policy decisions that enable buildout while leaving communities to negotiate alone.

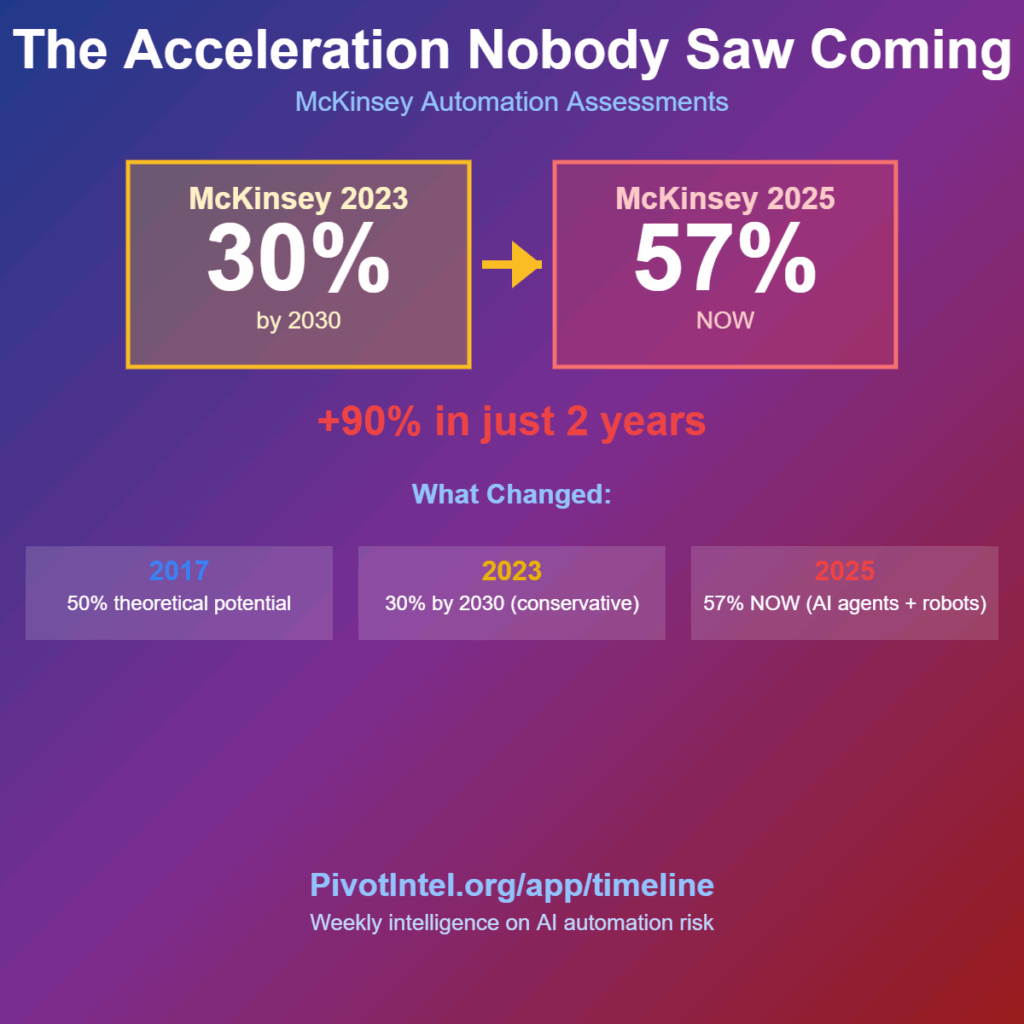

Platform Launch: Our new beta intelligence tracker at pivotintel.org/app provides the infrastructure math, employment data, and community impact analysis. It’s bare-bones functional now, expanding systematically as we verify sources.

Why This Newsletter Exists

While national outlets track headline announcements—Meta’s $600B, Microsoft’s $80B, Project Stargate’s $500B—the infrastructure transformation is happening at a scale that makes comprehensive coverage impossible.

Illinois has 224 existing data centers. Michigan has 17 active proposals. Wisconsin, Ohio, Indiana are adding dozens more. Each one represents billions in investment, hundreds or thousands of jobs, and massive community impact.

No single outlet can cover this depth. That’s the intelligence gap we’re filling: project-by-project tracking with the details that matter. Actual employment numbers versus announced numbers. Community costs per job created. Power grid implications. Tax revenue after abatements. What worked in similar negotiations elsewhere.

This is the infrastructure math that explains why Michigan handled Saline one way and rejected Howell another. Why your electricity rates are rising while promised tax revenue materializes slowly. Why temporary construction jobs get counted as permanent employment.

We’re building the platform that lets you compare how your state negotiated versus others, what your county is being offered versus what similar communities extracted, and whether the infrastructure math adds up before you walk into that public hearing.

Michigan Deep Dive: Two Projects, Two Outcomes

Saline Township: $7B Approved Pending MPSC via Settlement (With Concessions)

The Project:

- OpenAI/Oracle data center on 1,400+ acres

- $7 billion announced investment

- Washtenaw County, southeast Michigan

📅 Upcoming Critical Meetings

🔴 CRITICAL: Saline Township Data Center – MPSC Hearing

Date: December 3, 2025, 10:00 AM EST

What: Final hearing on DTE power contracts

Why It Matters: Sets precedent for how data center costs get allocated to residential ratepayers

Take Action: Submit comments by Dec 1 to mpsc.filing@michigan.gov

What Happened:

Community groups filed lawsuit challenging approval. Rather than fight, parties negotiated settlement. Saline Township voted 4-1 against the project in September, but Related Digital sued claiming “exclusionary zoning.” Facing what township attorney called “the lesser of two evils,” the board voted 4-1 to settle in October rather than fight in court. The settlement forced approval but secured $14M in community concessions that wouldn’t have existed otherwise.

The Deal:

- $14 million in community benefit agreement

- Specific infrastructure improvements

- Environmental monitoring commitments

- Local hiring provisions (with verification)

Employment Reality:

- 3,000 temporary construction jobs (announced)

- 50 permanent operations jobs (actual estimate)

- Local hiring: percentage TBD based on actual outcomes

The Power Impact:

1.4 GW energy demand. For context: that’s roughly 10% of DTE Energy’s total current capacity, for one facility.

Tax Abatement:

12 years, $100M+ in forgone tax revenue.

Cost Per Permanent Job:

If 50 permanent jobs materialize: $2M+ per permanent position in public subsidy.

What Made the Difference:

Organized community opposition forced negotiation. $14M in concessions wouldn’t have happened without the lawsuit.

Howell Township: $1B Rejected

The Project:

- Undisclosed developer (later revealed as Meta)

- $1 billion announced investment

- Livingston County, central Michigan

📅 Upcoming Critical Meetings

🟡 INFORMATIONAL: Howell Township – Status Update

Date: December 5, 2025, 7:00 PM

What: Township board discusses aftermath of rejection

Why It Matters: Case study in successful community opposition

What Happened:

7-hour public hearing, 500 attendees, overwhelming opposition.

Township Board Vote: 5-2 rejection

Community Concerns:

- Power grid strain (limited local capacity)

- Water usage (agricultural area with aquifer concerns)

- Traffic impact (rural roads not designed for construction)

- Minimal permanent employment (estimated 25-30 jobs)

- Tax abatement request (10 years)

The Opposition:

- “Preserve Howell” community group

- Livingston County Environmental Coalition

- Local farmers (land use conversion concerns)

- Residents (infrastructure strain)

What Made the Difference:

Community organized BEFORE the hearing. Residents came prepared with specific questions about infrastructure capacity, employment verification, and comparable projects elsewhere.

Township supervisors heard from their constituents and voted accordingly.

The Hidden Fiscal Cost: Established Data Centers at Risk

Michigan has 58 existing data centers. Those are real facilities with real employees that currently pay taxes in a local community. Next week, we deep dive into one of those facilities that is potentially at risk.

But here is a brief example. Washtenaw County collects $500,000 annually in property taxes from an established colocation facility operating since 2008. If that facility closes due to hyperscale competition while the new Saline data center operates under a 12-year tax abatement, the county doesn’t break even—it loses.

This is the fiscal math nobody’s tracking: existing data centers paying full freight today, new hyperscale facilities paying nothing for a decade, and the community caught in the middle when old facilities can’t compete and shut down.

We’re tracking both sides:

- NEW facilities: What tax abatements were granted, what’s the cost-per-job

- EXISTING facilities: What tax revenue is at risk, how many jobs could be displaced

- NET IMPACT: Is the community actually better off, or worse?

The Pattern: Infrastructure Without Accountability

What both cases show:

Announced Jobs ≠ Actual Jobs

- Construction jobs are temporary (18-36 months)

- Permanent operations jobs are minimal (50-100 typical)

- Local hiring percentages rarely verified

- “Economic impact” studies count indirect/induced jobs that may not materialize

Public Cost Rarely Disclosed Upfront

- Tax abatements (10-15 years typical)

- Infrastructure subsidies (roads, water, power upgrades)

- Utility rate impacts (residential customers subsidize industrial rates)

- Environmental review costs

Communities Negotiate Alone

- No standardized impact assessment

- Limited access to comparable project data

- Developers control information flow

- Short timelines between proposal and approval

This is why regional intelligence matters. Howell could see what happened in similar Michigan communities. Future communities can see what Saline negotiated and what Howell rejected.

The Power Grid Reality

DTE Energy (Southeast Michigan):

- Current capacity: 11 GW total

- Peak delivery: 9.5 GW

- Remaining capacity: 1.5 GW

- Data center pipeline in discussions: 7 GW

Translation: Data centers are requesting nearly 5x more power than DTE has available without major grid buildout.

Consumers Energy (West/Central Michigan):

- Current capacity: 7.6 GW

- Data center pipeline: 15 GW

- Translation: Would more than double their entire grid capacity

Combined Michigan demand being discussed: 22 GW for data centers alone

What This Means for You:

When utilities build new generation capacity to serve data centers:

- Construction costs passed to all ratepayers

- Data centers negotiate special discount rates

- Residential customers pay premium rates to subsidize industrial users

- Rate increases happen before facilities are operational (to fund buildout)

This is why your electricity bill is rising while utilities approve massive industrial customers. The infrastructure math is simple: someone has to pay for the new generation capacity, and it’s not the data centers getting negotiated rate discounts.

What We’re Tracking (Beta Platform)

Infrastructure Projects: 10 Verified National Projects

Currently tracking $81B in announced investment across 8 states:

- Google Texas: $40B (announced)

- Amazon Project Rainier (Indiana): $11B (operational)

- Microsoft Fairwater 2 (Georgia): $10B (construction)

- Saline (Michigan): $7B (approved)

- Amazon Northern Virginia: $5B (construction)

- Microsoft Mount Pleasant (Wisconsin): $3.3B (construction)

- Google Columbus (Ohio): $3B (announced)

- Meta Beaver Dam (Wisconsin): $1B (announced)

- Howell (Michigan): $1B (rejected)

- Meta DeKalb (Illinois): $74M (operational)

Why only 10 projects when there are hundreds?

Because we’re verifying every data point:

- Investment amounts from primary sources

- Actual vs announced employment numbers

- Community impact documented

- Tax abatement details where available

- Power/water requirements verified

We’re building depth, not just volume. Each project includes infrastructure math, employment reality, and community outcomes.

Expanding systematically:

- December: Additional Michigan projects (11 more documented)

- January: Great Lakes states (Wisconsin, Ohio, Indiana, Illinois)

- Q1 2026: Stargate expansion states (New Mexico, Wyoming, Pennsylvania, Georgia)

Enterprise Adoption Tracker

Who’s deploying AI and how many workers are affected:

We’re tracking 10 major enterprise deployments:

- JPMorgan Chase: 309K employees, 45K positions estimated at risk

- Amazon: 1.54M employees, 85K positions affected

- Walmart: 2.1M employees

- Target: 400K employees

- Salesforce: 72K employees, Agentforce deployment

- UPS: 495K employees, AI logistics rollout

- Anthem/Elevance Health: 98K employees, claims automation

- IBM: 282K employees, Watsonx deployment

- Bank of America: 213K employees, Erica AI expansion

- Microsoft: 220K employees (internal AI tools)

Total workers at companies deploying AI: ~5.9M across these 10 enterprises

Why this matters:

When Target announces AI deployment across 400,000 workers, that’s not corporate PR, it’s advance warning for those workers and their communities. The automation is happening whether or not anyone’s paying attention.

Partnerships & Deals: $522B+ in Investment

Major compute contracts and infrastructure investments:

- Project Stargate (OpenAI-SoftBank-Oracle): $500B over 4 years

- OpenAI-Microsoft extended partnership: $13B

- AWS-Saudi Arabia: $5.3B investment

- Anthropic-AWS: $4B compute contract

- AMD-xAI: Chip partnership (undisclosed value)

- Meta-AMD: Next-gen training chips

- Oracle-Google Cloud: Multi-cloud AI strategy

- Nvidia-Microsoft: GB200 supercomputer deployment

- xAI-Dell: Colossus infrastructure buildout

- Microsoft-Anthropic: Compute partnership

These aren’t just business deals, they’re commitments to infrastructure buildout that affects workers and communities.

When OpenAI, SoftBank, and Oracle announce $500B for Project Stargate, that means data centers in New Mexico, Wyoming, Pennsylvania. It means power grid upgrades, water usage, construction jobs (temporary), and permanent operations jobs (minimal).

Policy Developments: What Enables This vs What Protects Workers

We’re tracking 10 major policy decisions:

Enabling Infrastructure:

- Trump AI Executive Order revocation (removes safety requirements, environmental review)

- California SB 1047 veto (no AI safety mandates)

- DOE data center standards delayed until 2027

- Multi-state tax competition (15 states expanding data center incentives in 2025)

- UAE/Saudi chip export approvals

Protecting Workers (or attempting to):

- EU AI Act (requires worker consultation, transparency)

- SEC AI disclosure requirements (must report workforce impacts)

- NLRB AI surveillance restrictions (limits employer monitoring)

- Fed concerns about AI stock valuations

The pattern is clear: Policies enabling infrastructure buildout pass easily. Policies protecting workers or requiring transparency face opposition or delay.

Employment Data: The Two-Economy Split

Most recent verified data (released November 20, 2025):

Week ending November 15, 2025:

- Nonfarm payrolls: +119,000 jobs added

- Unemployment rate: 4.4%

- Initial jobless claims: 220,000

- Continuing claims: 1,974,000

- Automation-vulnerable sector losses: -31,000 (Challenger estimate for October)

Sources: Bureau of Labor Statistics (BLS), Federal Reserve Economic Data (FRED), Challenger Gray & Christmas

What this shows:

The economy is adding jobs overall (+119K) while specific sectors face automation pressure (-31K in vulnerable roles). This is the two-economy split: growth in AI-resistant roles, decline in automation-vulnerable positions.

From our November 14 Under the Radar newsletter:

- October 2025: 153,074 job cuts announced (highest October since 2003)

- AI cited in 31,039 cuts (#2 cause after cost-cutting)

- Technology sector: 33,281 cuts (6x September’s 5,639)

- Year-to-date 2025: 1,099,500 total cuts

This isn’t recession, it’s transformation. Companies are profitable, growing, and cutting staff simultaneously through automation gains.

The PivotIntel Tracker Platform (Beta)

Now live at pivotintel.org/app

What’s working:

- Infrastructure Projects tracker (10 verified projects, $81B+)

- Enterprise Adoption tracker (10 companies, ~5.9M workers)

- Partnerships & Deals tracker ($522B+ in investments)

- Policy Developments (10 policies, pro-infrastructure vs pro-worker)

- Employment Data (BLS/FRED verified monthly data)

What “beta” means:

- Data is manually verified before publication

- We’re building systematically, not rushing to volume

- Design is functional, expanding features based on feedback

- Coverage expands state-by-state as we verify sources

- Incomplete data may be present as details are added, but the data that is there will be verified.

Coming features:

- State-by-state comparison tools

- County-level analysis

- Historical trend visualization

- Cost-per-job calculators

- Community negotiation outcomes database

Why we built this:

Because the infrastructure transformation is happening at a scale no single outlet can cover comprehensively. We’re building the platform that provides:

For workers: Which projects are hiring, what skills are needed, what the actual wages are (not PR numbers), and whether jobs are going to local residents or traveling crews.

For communities: The questions worth asking at public hearings. Power and water requirements. Tax abatement math. Cost per permanent job created. What similar communities negotiated elsewhere.

For everyone: The infrastructure math that explains why your electricity rates are rising, why announced jobs don’t match actual employment, and what happens when communities organize versus when they don’t.

How to Use This Intelligence

If you’re looking for work:

Check the Infrastructure tracker for projects entering construction phase in your region. Note the timeline, skills required, and which contractors are hiring. Don’t wait for the “now hiring” announcement. By then, traveling crews have first access.

Follow the Enterprise Adoption tracker for which companies are deploying AI in your industry. If your employer is on this list, you have advance warning to either position for AI-adjacent roles or plan your transition.

If you live near a proposed data center:

Use the comparable projects data before your public hearing:

- What did similar-sized projects actually deliver for employment?

- What concessions did other communities negotiate?

- What happened to power rates in those areas?

- What percentage of construction jobs went to local residents?

Come to that hearing with specific questions based on actual outcomes elsewhere.

If you’re a career coach, recruiter, or workforce development professional:

The platform provides the intelligence your clients need:

- Which sectors are facing automation pressure vs which are growing

- Where infrastructure jobs are actually materializing

- What skills are transferable vs which are being automated

- Timeline for employment opportunities by region

What’s Next

Coming Next Week: The Hidden Fiscal Cost

Washtenaw County collects $500,000 annually in property taxes from an established colocation facility operating since 2008. If that facility closes due to hyperscale competition while the new Saline data center operates under a 12-year tax abatement, the county doesn’t break even—it loses.

This is the fiscal math nobody’s tracking: existing data centers paying full freight today, new hyperscale facilities paying nothing for a decade, and the community caught in the middle when old facilities can’t compete and shut down.

We’re tracking both sides:

- NEW facilities: What tax abatements were granted, what’s the cost-per-job

- EXISTING facilities: What tax revenue is at risk, how many jobs could be displaced

- NET IMPACT: Is the community actually better off, or worse?

Next Sunday’s deep dive: We’ll analyze Michigan’s 58 existing data centers, identify which are most vulnerable to hyperscale competition, calculate the fiscal impact if they close, and show communities the NET revenue calculation—not just the glossy economic development projections.

November 30 Newsletter:

- Deep dive: Hidden fiscal cost of existing data center displacement

- Case study: Michigan facility analysis with actual tax revenue data

- Community fiscal impact calculator methodology

- December 3 Saline MPSC hearing preview

Immediate (Next 2 Weeks):

- Expanding Michigan coverage (11 additional documented projects)

- Adding historical employment trend data

- Improving platform search and filtering

December 2025:

- Great Lakes regional expansion (Wisconsin, Ohio, Indiana, Illinois)

- State comparison tools (how Michigan negotiated vs Wisconsin)

- Community outcomes database

Q1 2026:

- Stargate expansion states (New Mexico, Wyoming, Pennsylvania, Georgia)

- National coverage for $1B+ projects

- Automated intelligence updates (currently manual verification)

- Premium data analysis features

Subscribe & Share

This newsletter is free. The core intelligence platform will remain free for workers and communities navigating this transformation.

Premium features coming 2026:

- Historical project database

- Predictive analytics (which communities likely targeted next)

- Customized regional alerts

- Detailed financial modeling tools

For now: We’re building the dataset, verifying sources, and providing honest intelligence about the infrastructure transformation reshaping employment and communities.

Subscribe: theopenrecordl3c.substack.com/subscribe

Platform: pivotintel.org/app (beta)

Feedback: angela@theopenrecord.org

Next Report: Sunday, November 30, 2025

PivotIntel operates within The Open Record as an L3C social benefit company. Our mission: provide honest intelligence to workers and communities navigating AI’s economic transformation. We’re funded by the founder (me, Angela Fisher, operating from Montmorency County, Michigan) and building toward workforce development grants in 2026.

All data manually verified. All sources documented. All analysis transparent. No corporate sponsorships, no vendor relationships, no conflicts of interest.

Questions? Corrections? Want to share your community’s data center story? Reach out.