Issue #2 – November 30, 2025

We are still building our resources and refining our process, but in this our second newsletter we are announcing a couple of really cool new features, along with setting the stage for 2026.

BY THE NUMBERS:

- 29 Projects Tracked nationwide

- $301.4B Total Investment announced

- 10 States with active projects

- NEW THIS WEEK: Wisconsin expansion adds $549M

🎯 WHAT’S NEW

Wisconsin: Google/Foxconn Partnership Expands

Investment: $549 million

Location: Racine County, WI

Status: Announced

Google’s expansion of the Foxconn partnership continues Wisconsin’s data center growth. This adds to the state’s position as a Great Lakes AI infrastructure hub.

🚨 NEW FEATURE: Occupation Risk Tracker

Real-time intelligence on AI’s impact across all U.S. job categories

We’ve launched a comprehensive tracker covering 22 major occupation categories (9+ million workers each). Every occupation gets:

- Risk score (0-100): Where 0 = critical risk, 100 = high opportunity

- Automation breakdown: Routine, cognitive, interpersonal, creative tasks

- Protection factors: What keeps you employed

- Vulnerabilities: What’s at risk

- Pivot paths: Recommended transitions with timelines

Key Findings from McKinsey (Nov 2025):

- 57% of U.S. work hours automatable with current technology

- 40% of jobs “highly automatable”

- Entry-level hiring already slowing (programmers, analysts, business operations)

- AI fluency demand grew 7x from 2023-2025

Most at Risk:

- Office & Administrative Support (25/100) – 19.7M workers

- Sales (40/100) – 14.6M workers

- Production (35/100) – 8.7M workers

Most Protected:

- Healthcare Practitioners (80/100) – 9.3M workers

- Protective Services (75/100) – 3.5M workers

- Skilled Trades (75/100) – 6.0M workers

View Full Occupation Risk Tracker →

Read the full McKinsey analysis: McKinsey’s November 2025 Bombshell

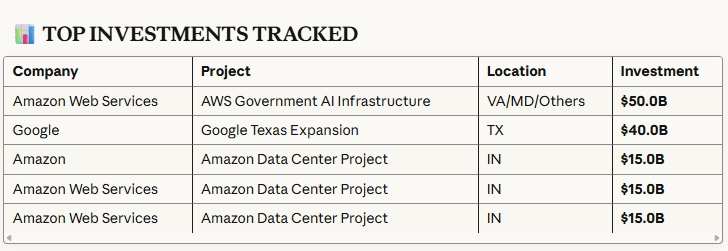

📊 TOP INVESTMENTS TRACKED

Note: The three $15B Indiana projects may represent phases of the same development. Source verification ongoing.

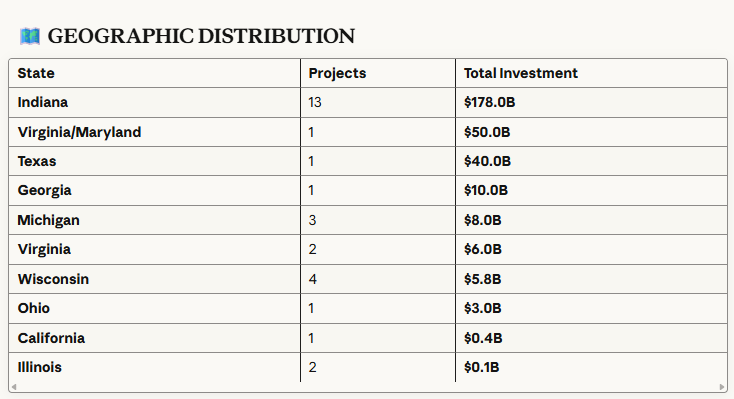

🗺️ GEOGRAPHIC DISTRIBUTION

Regional Patterns:

- Indiana: Massive concentration ($178B across 13 projects) – likely includes Amazon’s New Carlisle megaproject

- Virginia/Texas: Federal government and hyperscale concentration

- Great Lakes: Wisconsin, Michigan, Ohio emerging as regional hub

- Southeast: Georgia expansion continues

🚧 BETA STATUS & EXPANSION ROADMAP

Current Coverage: National Projects

- Automated collection from tech news, data center industry sources

- Company press releases (Meta, Google, Amazon, Microsoft)

- Manual verification before publication

Coming December 2025: Michigan Deep Dive

- Bridge Michigan, Detroit Free Press, MLive regional coverage

- County planning commission tracking

- Community opposition outcomes

- Local hiring data vs. announced projections

- Tax incentive analysis by project

Q1 2026: Great Lakes Regional Expansion

- Wisconsin (Meta Beaver Dam, Microsoft facilities)

- Ohio (185+ existing data centers)

- Indiana (Michigan City, northern Indiana projects)

- Illinois (224 data centers – most active in region)

Methodology Refinement: We’re still beta-testing our automated collection and verification workflows. You may notice:

- Some duplicate entries being cleaned up

- Investment amounts verified against multiple sources

- State-level data improving as regional coverage expands

Your Feedback Matters: Found an error? Have local intelligence we missed? Email us or comment on Substack. We’re building this to serve workers and communities – your ground-level knowledge makes it better.

🔍 METHODOLOGY

Data Collection (Beta Phase):

- Automated daily scraping of national tech, data center, and business news

- Michigan regional sources launching December 2025

- Company press releases and investor filings

- Public permit and planning commission records

Quality Control:

- Manual verification of all projects before publication

- Source archiving via Wayback Machine

- Duplicate detection across staging and production databases

- Confidence scoring (30-100%)

What We Track:

- Investment amounts (announced and actual)

- Construction timelines

- Employment projections (temporary and permanent)

- Community opposition and outcomes

- Tax incentives and public subsidies

Beta Testing Notice: We’re refining our collection and verification processes. National coverage is operational; regional coverage expands December 2025 (Michigan) and Q1 2026 (Great Lakes). Data accuracy improves weekly as we validate sources and remove duplicates.

📌 COMING THIS WEEK

“AI Is Not a Bubble” Series Continues:

Article 2: The Federal AI Infrastructure Push

Examining:

- Amazon’s $50B federal government contract – what it means for workers

- Military data center expansion – geographic distribution and opportunities

- Agricultural AI applications – rural infrastructure impact

- Security clearance opportunities – job protection premium for displaced workers

What makes government/military different:

- Long-term contract stability vs. private sector volatility

- Security clearance = competitive advantage

- Geographic distribution (rural military bases, federal facilities)

- Agricultural AI creates regional opportunities beyond urban centers

Subscribe to get it first: theopenrecordl3c.substack.com

🔗 RESOURCES

Track Your Career Risk:

- Occupation Risk Tracker – 22 major job categories analyzed

- Under the Radar Newsletter – Weekly career opportunities (published Thursdays)

Infrastructure Intelligence:

- PivotIntel App – Full project database

- McKinsey Analysis – November 2025 findings

- Under the Radar – Nov 28 – Latest weekly edition

Next Edition: December 7, 2025

PivotIntel provides regional AI infrastructure intelligence for workers, communities, and professionals navigating the AI transformation. Free subscription at theopenrecordl3c.substack.com